ANOTHER DAY—ANOTHER STARTUP INSIGHT

Hey founders, 👋

We’re opening up sponsorship opportunities. We’re here to help early-stage founders like you get the spotlight you deserve — without needing press connections, PR budgets, or flashy metrics. We believe every startup story matters, especially the ones just getting started.

If you’re building something awesome and want to share your story with a startup-savvy audience (including potential users, partners, and investors), we’d love to help.

You can find more details about this sponsorship at the link below:

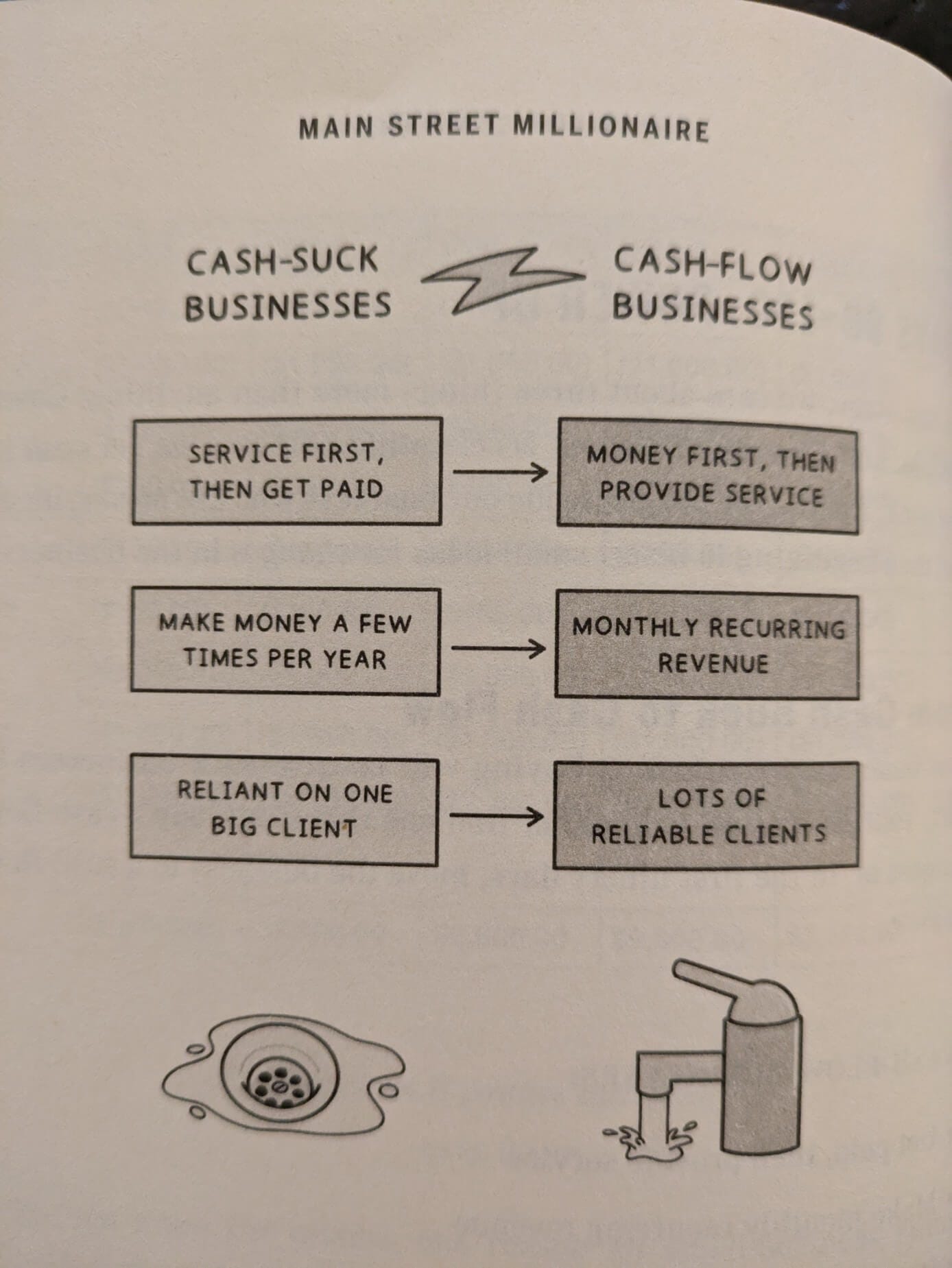

When it comes to building a business, there are really two kinds of games you could be playing — often without even realizing it.

You’re either building a cash suck business... or a cash flow business.

And trust me, which one you're building makes all the difference between sleeping peacefully and sweating through your sheets every night.

Let's break it down.

What's a cash suck business?

A cash suck business is exactly what it sounds like:

It devours cash faster than it generates it.

You’re constantly pouring money into the business just to keep the lights on.

Without outside funding — whether it’s your savings, investors, or bank loans — the business can’t survive for long.

Common traits of cash suck businesses:

High upfront costs (manufacturing, R&D, long development cycles)

Long sales cycles (enterprise software, biotech, hardware)

Heavy dependency on external capital for scaling

Break-even is far, far away — sometimes years.

Examples:

A new hardware startup developing a smart home device (needs tons of R&D, manufacturing setup, and months to years before any meaningful revenue).

A marketplace business that has to subsidize users heavily at the start (think Uber, Airbnb in the early days).

D2C (direct-to-consumer) brands spending millions on marketing before hitting brand awareness and profitability.

Warning signs you’re running one:

Burn rate is growing faster than revenue.

“Raise another round” is your main growth strategy.

Your metrics only look good if you squint and use creative accounting.

What's a cash flow business?

On the other hand, a cash flow business does something magical:

It generates more cash than it consumes — and often does it quickly.

Common traits of cash flow businesses:

Low upfront costs

Fast sales cycles (weeks or even days)

Predictable, recurring revenue

Profitability can be achieved early — and reinvested for organic growth.

Examples:

A marketing agency doing paid ads for small businesses (get a client, get paid next month).

A digital product business — like a course, template, or SaaS tool — that costs little to deliver after it's created.

A service-based business: bookkeeping, freelance design, coaching.

Warning signs you’re running one (and they’re good signs!):

You’re profitable or cashflow positive within months.

You can fund your growth out of your own profits.

You sleep better at night because you're not constantly fundraising.

Why this distinction matters more than you think

Most first-time founders glamorize the cash suck model because that's what we hear about in the media:

Big venture rounds.

Unicorn valuations.

"Blitzscaling."

But what they don’t tell you is that most cash suck businesses fail — because they simply run out of cash before hitting product-market fit.

Meanwhile, cash flow businesses fly under the radar.

They’re less sexy on TechCrunch... but they actually:

Survive longer

Give founders more control

Create true wealth (because you’re not diluted down to nothing)

In fact, many founders who succeed in cash suck startups later switch to building cash flow businesses for their second or third ventures.

Because they’ve learned the hard way:

Freedom > Fame.

Don't mistake cash flow for revenue!

One of the biggest traps early-stage founders fall into is confusing revenue with cash flow.

Revenue = the total amount you've billed or earned on paper.

Cash flow = the actual cash that hits your bank account.

They are not the same thing — and mistaking one for the other can kill a business faster than you think.

Here’s why:

You can have high revenue, but poor cash flow if your customers pay late (or worse, don't pay at all).

You can "grow" your revenue aggressively while secretly digging a giant cash hole underneath you.

You can look great on paper — and be just weeks away from running out of money.

Example:

Imagine you sign a $100,000 contract today. You book it as revenue. But the client only agrees to pay after the project is completed — in 9 months.

Meanwhile, you’re still paying salaries, rent, and tools today. That’s how companies collapse even with “millions in revenue” — because they’re bleeding cash every month.

Quick mental model:

Revenue shows your potential.

Cash flow shows your reality.

You can’t pay employees, rent, or yourself with promises.

You can only pay with cash in the bank.

Choosing your path — key questions to ask

Before you dive into your next big idea, or even if you're mid-build right now, ask yourself:

How long will it realistically take to reach profitability?

How much upfront capital will I need — and where will it come from?

Can I test the market and start generating revenue before I run out of money?

Am I prepared to fundraise — again and again — if needed?

Sometimes, building a cash suck business is unavoidable (especially in deep tech, hardware, or ambitious network-effect startups).

But even then — the smartest founders simulate cash flow early through services, partnerships, or side projects to extend their runway.

Example: Airbnb sold cereal boxes to survive in 2008.

Read their amazing story here:

How to audit your business: cash flow or cash suck?

Not sure which camp your business falls into?

Here’s a simple audit you can do right now:

1. Look at your monthly cash flow statement

Is cash inflow > cash outflow each month?

If yes, you’re likely a cash flow business.

If no, you’re running a cash suck.

Even if you're growing revenue, if expenses grow faster than cash collected, you're burning cash.

👉 Tip: Pay special attention to how fast you collect money after making a sale (your receivables).

2. Track time to profit per sale

How long does it take from acquiring a customer to actually earning a profit from them?

If it's immediate or within a few weeks → cash flow.

If it's months or years → cash suck.

👉 Tip: For SaaS or subscriptions, calculate the payback period on customer acquisition cost (CAC).

3. Analyze your customer payment terms

Are customers paying upfront, upon delivery, or months after?

Getting paid before delivering value = cash flow.

Delivering value and waiting months = cash suck.

👉 Tip: If possible, introduce incentives for upfront payments (like discounts, bonuses, or limited offers).

4. Check your burn rate vs. growth rate

Is your monthly "burn rate" (cash out minus cash in) increasing? And is your growth rate (new revenue or customers) catching up fast enough to cover the burn?

If not, you're deep in cash suck territory.

👉 Tip: Start modeling different "cash runway" scenarios (e.g., what happens if revenue slows by 20% next quarter?).

5. Evaluate funding dependence

If you didn’t raise another dime, could your business survive for the next 12 months?

If yes, congrats — you’re operating cash flow positive.

If no, you’re depending on external oxygen (aka cash suck).

👉 Tip: Build a "self-sufficiency plan" — how fast could you cut costs, boost cash collections, or add cash-generating products if needed?

Cash flow-friendly pricing models that startups can apply

The smartest startups bake cash flow into their business models early, through smart pricing and revenue structures.

Here are a few models that help boost cash flow early, even for startups:

1. Upfront annual payments (prepay model)

Model:

Instead of monthly billing, offer customers a discount if they pay for a full year upfront.

Example:

Beehiiv (the newsletter platform) gives a big discount for annual payments, boosting cash in the bank.

Notion and Slack do the same — giving discounts to users who pay 12 months at once.

Why it helps cash flow:

You collect 12 months of cash today, not drip it out slowly.

Read their stories here:

2. Pay-per-use (variable usage pricing)

Model:

Instead of a fixed flat fee, charge based on how much customers actually use.

Example:

Twilio: charges per message, call, or API usage.

AWS: pay only for what you use in storage, compute.

Why it helps cash flow:

Customers pay relative to the value they extract. Easier to land customers (low upfront cost) but still scale big bills with big users.

3. Freemium → Fast conversion (with critical limiters)

Model:

Offer a free tier but design critical limitations (like storage, usage, team size) that force real users to upgrade quickly.

Example:

Dropbox: free limited storage → paid upgrades.

Figma: free for solo or small teams → paid once collaboration grows.

Why it helps cash flow:

You seed the market fast, but the conversion to paid happens before free users become cash suckers.

4. Credits-based pricing

Model:

Sell users a bundle of “credits” or “tokens” upfront, which they can use over time — similar to a digital punch card.

Examples:

OpenAI API sells tokens.

Canva offers credit packs for premium images and designs.

Why it helps cash flow:

You collect payment upfront, even though usage may spread over months. It also encourages customers to stay engaged (to use what they paid for).

5. Founding customer / lifetime deal model

Model:

Offer early adopters a one-time lifetime access or “founder deal” if they pay upfront. It pulls in cash fast and rewards early supporters.

Examples:

ConvertKit did this in the early days.

Many bootstrapped SaaS apps use AppSumo to sell lifetime deals for fast capital.

Why it helps cash flow:

Gives you early funding without equity dilution. If done well, it builds a loyal early customer base, too.

Read more about Appsumo here:

6. Pre-order with tiered pricing

Model:

Before you even launch the product, collect pre-orders at discounted rates. Offer higher tiers with added benefits (early access, coaching, community).

Examples:

Many indie SaaS tools and courses do this on Gumroad, Lemon Squeezy, or Kickstarter.

Why it helps cash flow:

Get paid before you build + validate interest in one shot.

Founder reflection: know your risk appetite

At the end of the day, it comes down to risk appetite:

Cash suck businesses are moonshots.

→ High risk, high reward... and a high chance of blowing up.Cash flow businesses are base hits.

→Lower risk, steady growth, and full control.

Neither is morally better.

But knowing which game you’re playing — and being honest with yourself about it — can save you years of heartache, and maybe even your entire startup.

Because hustle can’t save a cash suck.

And a well-run cash flow business rarely needs saving.

TL;DR

Cash Suck = Cash-burning, investor-dependent.

Cash Flow = Cash-earning, self-sustaining.

Know what you’re building — and why.

Freedom is worth more than fame.

Bottom line

High revenue is nice.

Positive cash flow is necessary.

Chasing revenue without managing cash flow is like trying to win a marathon by sprinting the first mile and then collapsing.

So, if you're thinking of starting something soon…

Build a small cash flow engine first.

It can fund your big dream later — and save you from giving up 90% of your company before you even get started.

THANKS FOR READING!

- Gracie from What A Startup